Quick personal loans in Montréal

Search by Postal Code or City and ProvinceMontréal Branches

-

kmX

-

kmX

-

kmX

-

kmX

How to get a personal loan in Montréal

-

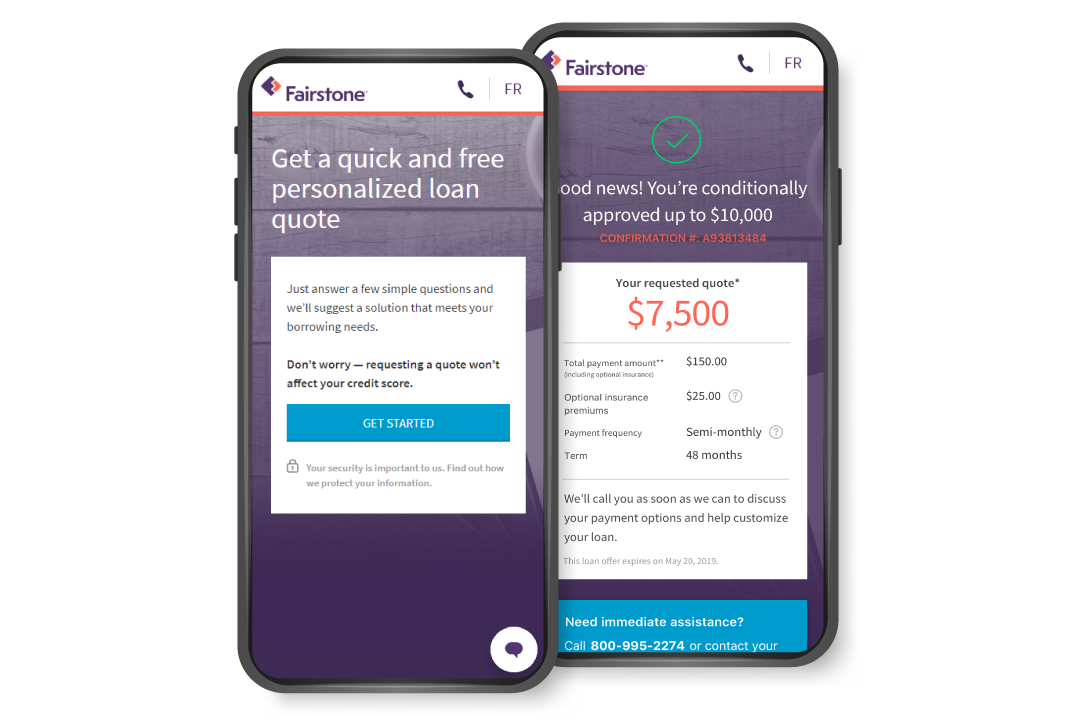

Get an online quote

Answer a few simple questions and receive your loan quote in minutes. There is no obligation and no impact to your credit score.

-

Connect with a Lending Specialist

A Lending Specialist will contact you to customize your loan.

-

Complete the loan application

You can submit the required documents online or in person at one of our Montréal branches, depending on the type of loan you choose.

Types of loans in Montréal

Here are the personal loans available at your local branch:

Unsecured personal loans

Cover unexpected expenses, consolidate debt and more with an unsecured personal loan up to $25,000 from Fairstone. A Lending Specialist will work with you to find a payment schedule that suits your needs, budget and lifestyle.

Secured personal loans

Homeowners can access lower interest rates, lower payments and greater borrowing power with a secured personal loan from Fairstone. Ask your Lending Specialist about a secured personal loan to borrow up to $60,000.

Debt consolidation loans

Combine multiple bills into one simple monthly payment with a debt consolidation loan from Fairstone. Consolidate credit card debt, overdue bills and more. Get a loan quote to find out how we can help you save money and pay off debt faster.

Emergency loans

Manage unexpected expenses with a personal loan from Fairstone. Access up to $60,000 to cover the cost of home repairs, car repairs, vet bills and more. Looking to borrow a greater sum? Borrow up to $600,000 with mortgage refinancing.

Home equity loans

Convert home equity into money you can access for debt consolidation, home repairs, large expenses and more. Ask your Lending Specialist about a home equity loan today to borrow up to $600,000.

What do I need to qualify for a personal loan?

To finalize your loan application, you’ll need to provide verification documents:

- Valid personal identification – either one piece of primary identification like a driver’s licence or passport, or two pieces of secondary identification like a Canadian birth certificate or current bank statement with your full name and address

- Employment or income verification like a current T4 or pay stub

- Housing information like a mortgage statement or lease agreement

Learn more about the verification documents required for your loan.

Why choose one of our Montréal branches for your loan?

Not only do we have four convenient branches located in Montréal, you can also complete your loan application online. Additionally, we’ve been providing Canadians with responsible loans for almost 100 years.

The Montréal community

Montreal, Quebec, is named for nearby Mount Royal’s three peaks, which make it look like a crown. The picturesque city itself is the largest in the province of Quebec, with the centre of the city built on an island in the St. Lawrence River. Numerous boroughs fan out from that center point.

Montreal was named a UNESCO city of design in 2006, and since then, this French-Canadian region has grown to become the second largest population in Canada. Montreal’s diverse metropolitan area is home to numerous theatres, festivals, TV and radio companies and musical venues. The city is a great place for sports fans to live or visit as it’s home to the Montreal Canadiens hockey team and Montreal Alouettes football team.