Quick personal loans in Toronto

Search by Postal Code or City and ProvinceToronto Branches

-

kmX

-

kmX

-

kmX

-

kmX

-

kmX

-

kmX

-

kmX

-

kmX

How to get a personal loan in Toronto

-

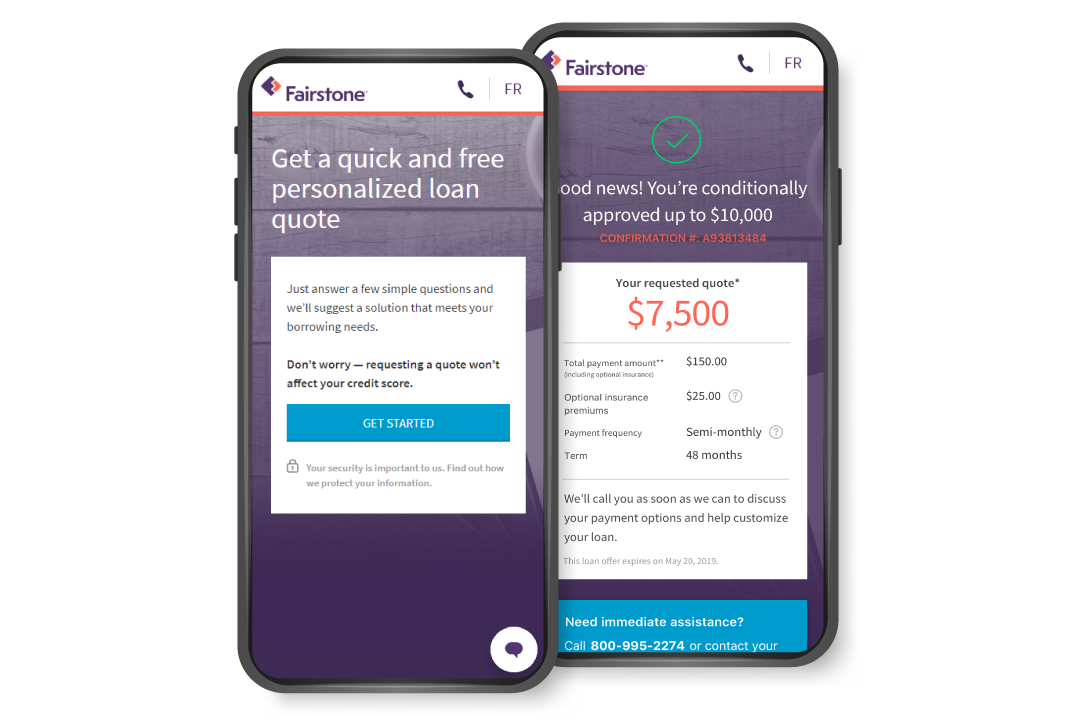

Get an online quote

Answer a few simple questions and receive your loan quote in minutes. There is no obligation and no impact to your credit score.

-

Connect with a Lending Specialist

A Lending Specialist will contact you to customize your loan.

-

Complete the loan application

You can submit the required documents online or in person at one of our Toronto branches, depending on the type of loan you choose.

Types of loans in Toronto

Here are the personal loans available at your local branch:

- Loan amounts: Borrow $500-$25,000 as soon as the day you apply

- Loan term: 6-60 months

- Homeownership required: No homeownership required

- Prepayment penalty: No pre-payment penalties so you can pay off the loan when it’s convenient for you

Unsecured personal loan

- Loan amounts: Borrow $5,000-$60,000

- Loan term: 36-120 months

- Homeownership required: Yes

- Access a lower interest rate, lower payments and more money than with an unsecured personal loan

Secured personal loan

What do I need to qualify for a personal loan?

To finalize your loan application, you’ll need to provide verification documents:

- Valid personal identification – either one piece of primary identification like a driver’s licence or passport, or two pieces of secondary identification like a Canadian birth certificate or current bank statement with your full name and address

- Employment or income verification like a current T4 or pay stub

- Housing information like a mortgage statement or lease agreement

Learn more about the verification documents required for your loan.

Why choose one of our Toronto branches for your loan?

Not only do we have four convenient branches located in Toronto, you can also complete your loan application online. Additionally, we’ve been providing Canadians with responsible loans for almost 100 years.

The Toronto community

A dynamic and sprawling metropolis boasting numerous skyscrapers, including the famous CN Tower, which is the tallest free-standing structure in the Western Hemisphere, as well as numerous parks and green spaces, Toronto is the capital of Ontario. Referred to as “The Six” by locals, the city offers both residents and tourists a several options when it comes to dining, shopping, sporting events and recreation.

With the Toronto Zoo, the Royal Ontario Museum, the Art Gallery of Ontario, the Hockey Hall of Fame and Ripley’s Aquarium of Canada, there is no shortage of things to do. Sports fans can watch a number of professional sports teams including the Maple Leafs, Blue Jays, Raptors and Argonauts.

Toronto is the anchor of the Golden Horseshoe, the fourth largest city in North America and a mecca for arts and media, including movie and TV production, music and theatre.